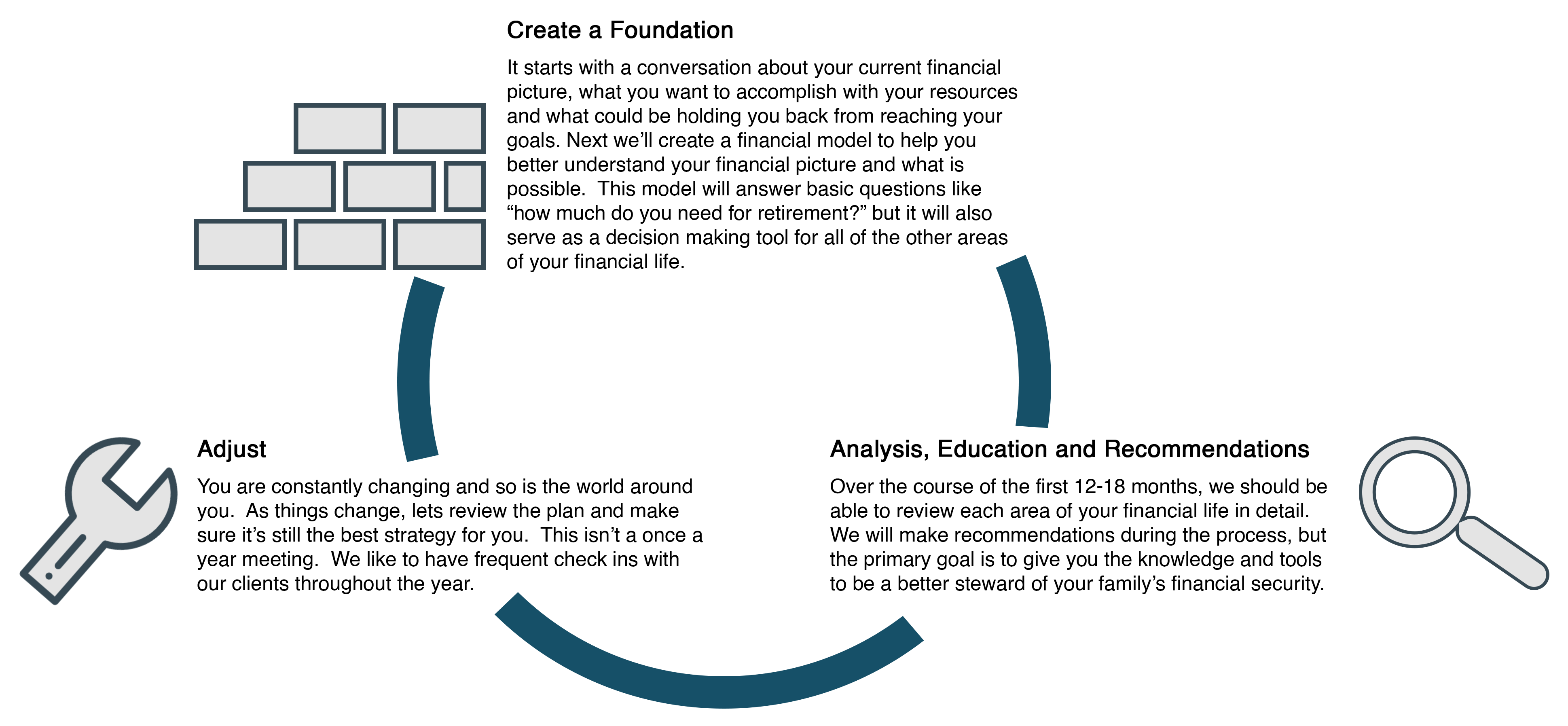

Create A Foundation

It starts with a conversation about your current financial picture, what you want to accomplish with your resources and what could be holding you back from reaching your goals. Next we’ll create a financial model to help you better understand your financial picture and what is possible. This model will answer basic questions like “how much do you need for retirement?” but it will also serve as a decision making tool for all of the other areas of your financial life.